About

VIGA Real Estate

VIGA has a clear focus on Core/Core+ residential properties in the Copenhagen area with central locations and low vacancy risk.

VIGA believes Copenhagen offers sustainable long term economic and population growth. The Copenhagen real estate market is considered a ‘safe haven’ with high international demand – in particular for Core residential properties.

VIGA currently manages 22 properties in the central Copenhagen area with more than 657 tenancies and approximately 54.900 sqm. share of residential GLA (around 83% residential and 17% commercial).

Our investment strategy is based on careful in-depth due diligence, intensive hands on management, and leveraging our extensive network within the property and financial industries.

VIGA is a lean specialised organisation with a focus on value creation for its investors, which consist of Danish, Swiss and EU professional and institutional investors. VIGA management always co-invests alongside our investors.

VIGA is registered at the Danish Financial Supervisory Authority as manager of alternative investment funds (FAIF).

Investment Strategy

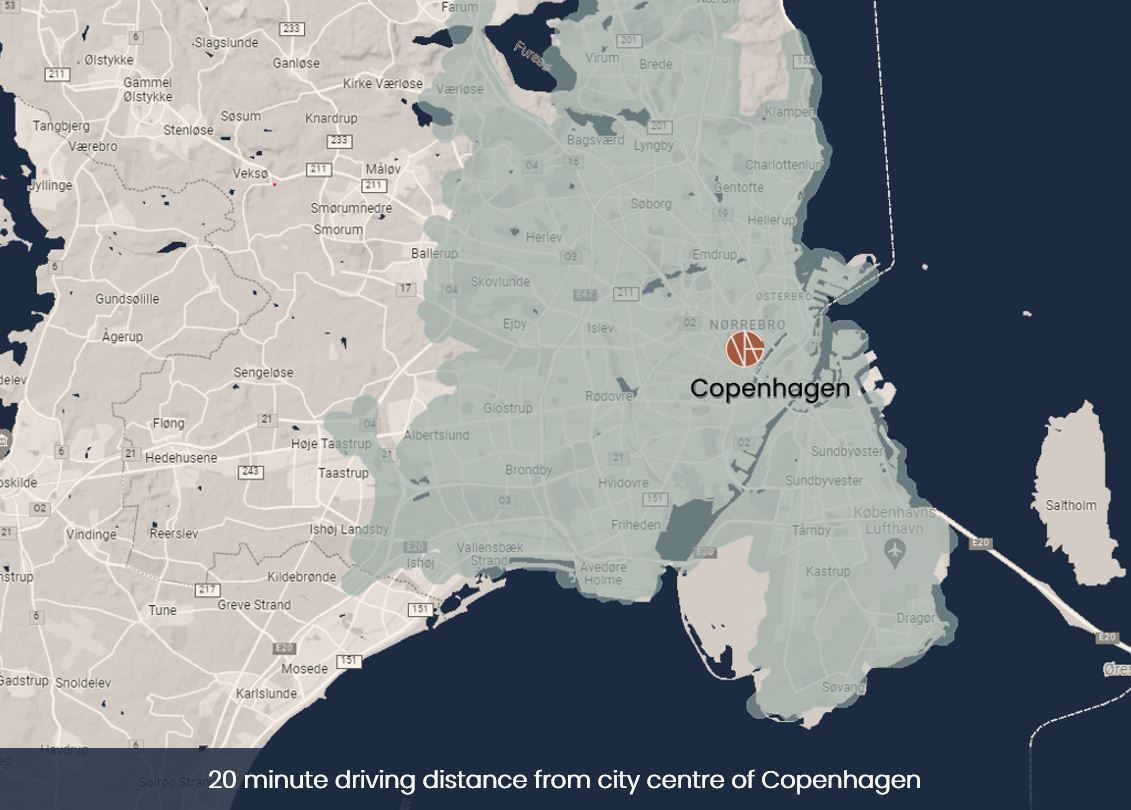

- Viga´s investment strategy focuses on centrally located Core and Core+ residential properties within a 20- minute commute of Copenhagen´s city centre

- Locations with close proximity to the motorway, railway, metro and bicycle grid.

- By collecting a centrally located portfolio of residential properties and executing on asset management plans, Viga is likely to obtain a meaningful valuation premium at exit.

- Viga enjoys a competitive advantage:

- Forcus on medium sized residential properties that are often too large for HNWI and too small for institutional investors.

- Extensive network for sourcing attactive properties.

Board members

Chairman of Jeudan from 1994-2014 where he helped grow the asset base from DKK 0.3bn to DKK 19bn. Niels was actively involved in all investment decisions, restructuring and setting up investment guidelines.

Niels reviewed all investments (and divestments) together with the management team and would personally visit all material acquisitions

Chairman of M. Goldschmidt, one of the largest privately owned real estate companies in Copenhagen (2015-2020)

Appointed by the Central Bank of Denmark and ‘Finansiel Stabilitet’ to restructure banks that had failed during the financial crisis due to mismanagement of real estate exposure (2008-2011)

40 years at leading Danish law firm, Gorrissen Federspiel (GF), which he joined after graduating from the University of Copenhagen in 1981 (Cand.Jur). He served as managing partner (2003-2010) and chairman (2010-2015). At GF he was also responsible for completing the iconic Axel Tower in Copenhagen and landlord negotiations. GF leases 14,500 sqm out of 17,000

Niels left GF in 2021 to join Danske Bank as Senior General Counsel

nh@vigarealestate.com

Co-Founder SFP Group AG

2001 Co-founder and shareholder of Swiss Finance & Property Ltd

Vice-President of the Board of Directors SFP Group AG

Member of the Foundation Board SFP Investment Foundation

From 2018 to 2022, CEO SF Urban Properties Ltd

From 1998 to 2001 Partner of Swiss Capital Alternative Investments AG, Property Marketing & Sales

From 1993 to 1998 UBS AG, responsible for trading and selling securities for Swiss shares for institutional customers and qualified private customers; previously UBS training programme

Kaufmann EFZ, SIX Swiss Exchange trader’s licence

schenker@sfp.ch

10 years at Goldman Sachs with focus on debt capital markets and wealth management

Founder of NICG (Nordic Insurance Consolidation Group) in 2014, which acquired Skandia Liv A and

Liv B (renamed Norli Pension)

3.5 yrs at a global family owned business. Responsible for portfolio optimisation, acquisitions, implementation and CEO

Optimisation, acquisition and structuring of multiple real estate portfolios and transactions in Denmark

In total more than 20 years of capital markets and M&A/corporate finance execution experience

Graduated as Cand.Polit (MSc. Economics) from the University of Copenhagen in 2001

kgv@vigarealestate.com

+20 Years in Danish Banking focusing on wealth management, accounting and business development.

Co-founder and CEO with Clearhaus. Clearhaus was the first Danish Payment Institute and with acquiring license from Visa and MasterCard. Clearhaus was recently sold in the largest Danish Fintech transaction to date.

Partner in proVeo Group and CEO of proVeo. proVeo specializes in assisting hnwi-investors getting the best possible risk-adjusted return for their portfolios based on a holistic approach.

Established an alternative investment fund focusing on property, solar, windpower and other renewables

elsberg@proveo.dk

Rolf has been a managing director of Beisheim Management AG in Baar since 2016. After commercial training in industry, he studied part-time to become a graduate expert in accounting and controlling.

Rolf began his career in western Switzerland at a national trust company. This took him via business accounting and controlling at a Swiss industrial group to Metro International AG, where he took on various leadership functions.

He then spent over twenty years working in various functions including as a CFO in HNWI Single Family Office.

furrer@beisheim.com